What Are the Two Basic Types of Product Costing Systems

It establishes current state costs and can establish a framework for. This is because costing plays a role in the reconciliation of the two activities.

Normal Costing System And Product Costs Double Entry Bookkeeping

During the industrial revolution when the complexities of running large scale businesses led to the development of systems for recording and tracking costs to help business owners and managers make decisions.

. Costing is the deciding factor of the prices and the important thing to be followed in all important stages like purchase production marketing sales etc. The year 2 variable costing statement reported a profit whereas the year 2 absorption costing statement reported a loss. Costing provides a tool for price fixation as well as price control.

One such method is the activity-based costing ABC method which calculates the cost of activities and helps in making decisions on product mix. Bottom-up product-level costing where costs are quantified in direct relation to resource utilization represents an effective solution to the limitations of top-down costing providing valuable inputs to decision making in the interest of delivering quality care in a cost-efficient manner. Recipes may have all three types of measurement.

Activity Based Costing ABC Activity based costing is a costing method that has been developed to deal with the perceived weaknesses of traditional absorption costing. The cost calculation in the textile industry is. There are three types of measurements used to measure ingredients and to serve portions in the restaurant trade.

Problems with traditional absorption costing. Fundamentally costing also controls costs. This is reflected in the choice of.

Types of Measurements Used in the Kitchen. Poly is estimated to have 800000 setups and 450000 inspections while silk has 400000 setups and 150000 inspections. LCC also known as total life-cycle costing TLCC is the sum of all types of costs.

Setup with an estimated 120000 in overhead and inspection with 30000 in overhead. The objective of LCC analysis is to select the most cost-effective least cost approach among various alternatives to achieve the lowest long-term cost of ownership 35. Acquisition ICC OM and decomposition incurred over the lifetime of a project discounted to the present 34.

Understand the types of financial transactions and. Costing also compares the respective costs of different methods machines and systems and it helps in decision-making in this regard. How much overhead is applied to each product.

Polyester poly and silk. Financial transactions are when the value of an asset liability or owners equity changes. Technically a travel agent is an owner or manager of an agency but other employees are responsible for advising tourists and.

1 Better Decision Within a particular life cycle stage better decisions can be taken with the help of accurate and realistic assessment of. Various techniques used by cost accountants include standard costing and variance analysis marginal costing and cost volume profit. A single-product company prepares income statements using both absorption and variable costing methods.

The choice of cost driver is rated as. The closer the cost calculation is to actual resource consumption the higher the score. All types of businesses.

There are two cost pools. Frenchys makes two types of scarves. He acts on the behalf of product providersprinciples and in return gets a commission.

A travel agent is a person who has full knowledge of tourist product destinations modes of travel climate accommodation and other areas of the service sector. Measurement can be by volume by weight or by count. Costing standards in the United Kingdom recognize that different costing methods exist within costing systems.

Advantages of Product Life Cycle Costing. A recipe may call for 3 eggs measurement by count 250 mL of milk measurement by. Costing is the system of computing cost of production or of running a business by allocating expenditure to various stages of production or to different operations of a firm.

The main advantages of product life cycle costing are as under. Manufacturing overhead cost applied per unit produced under absorption costing in year 2 was the same as in year 1. At the provider level materiality and quality scores MAQS are used to rate the quality of cost information based on the choice of cost drivers.

Traditional absorption costing is based on the principal that production overheads are driven by the level of production.

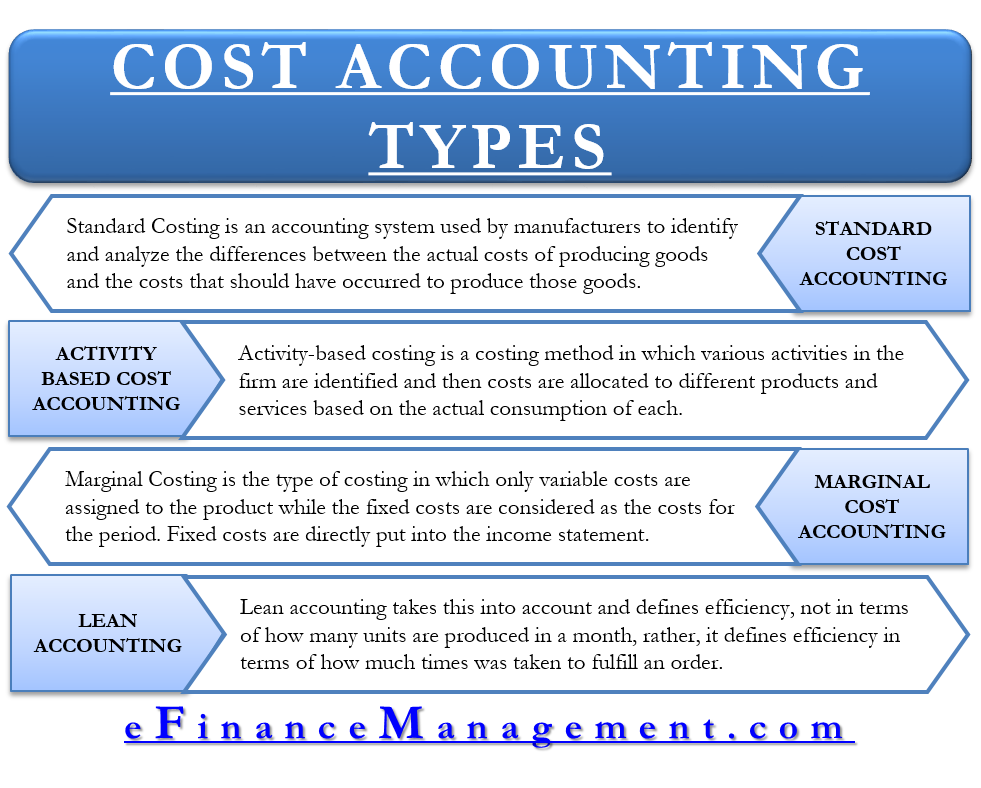

Types Of Cost Accounting Standard Activity Based Marginal Lean Efm

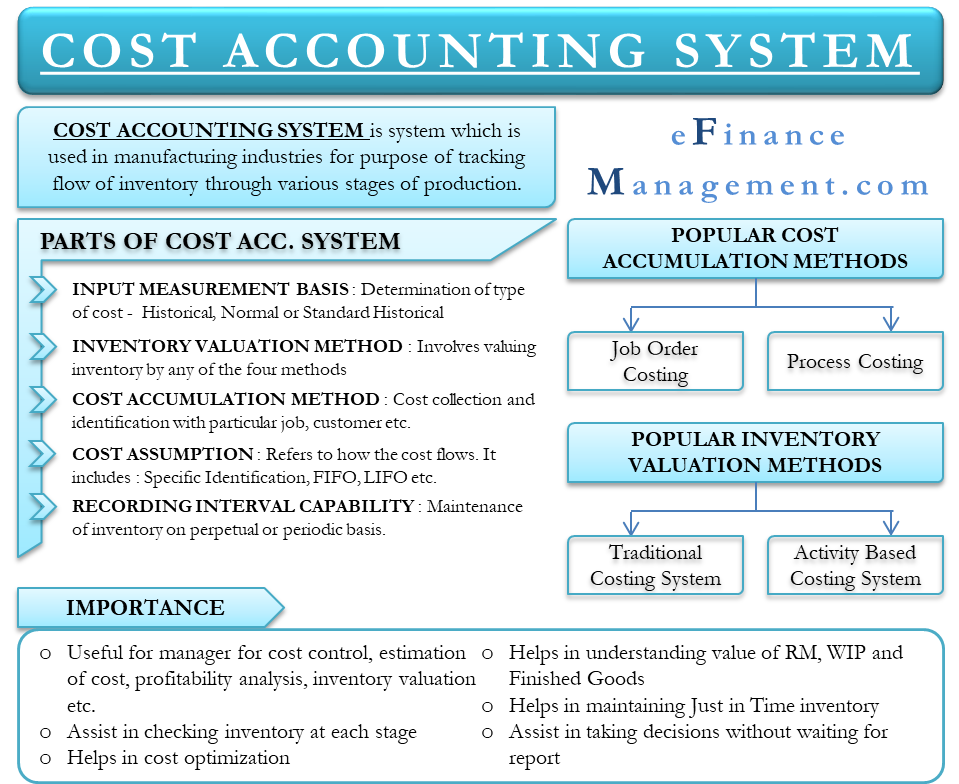

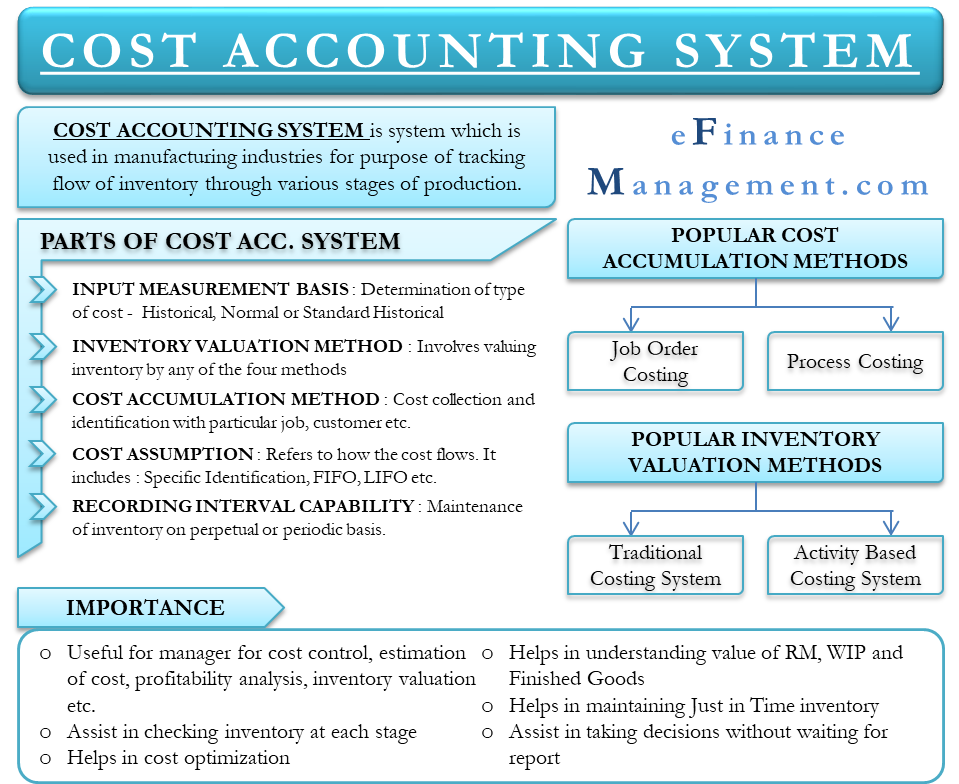

Cost Accounting Systems Meaning Importance And More

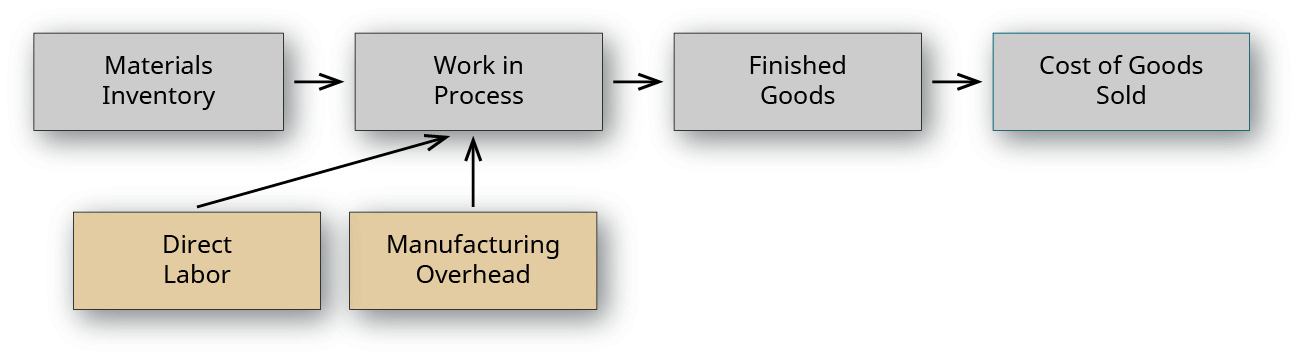

Describe And Identify The Three Major Components Of Product Costs Under Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

No comments for "What Are the Two Basic Types of Product Costing Systems"

Post a Comment